Have you ever wondered why more and more American seniors are choosing to retire early? In this article, we will explore the growing trend of early retirement among seniors in the United States. From the factors contributing to this shift in retirement plans to the potential benefits and challenges faced by those who choose to retire early, we will examine the various aspects of this evolving landscape. Whether you are a current retiree, approaching retirement age, or simply curious about the changing dynamics of retirement, this article aims to provide you with a deeper understanding of this trend.

Understanding the Growing Trend of Early Retirement Among American Seniors

Reasons for the Increase in Early Retirement

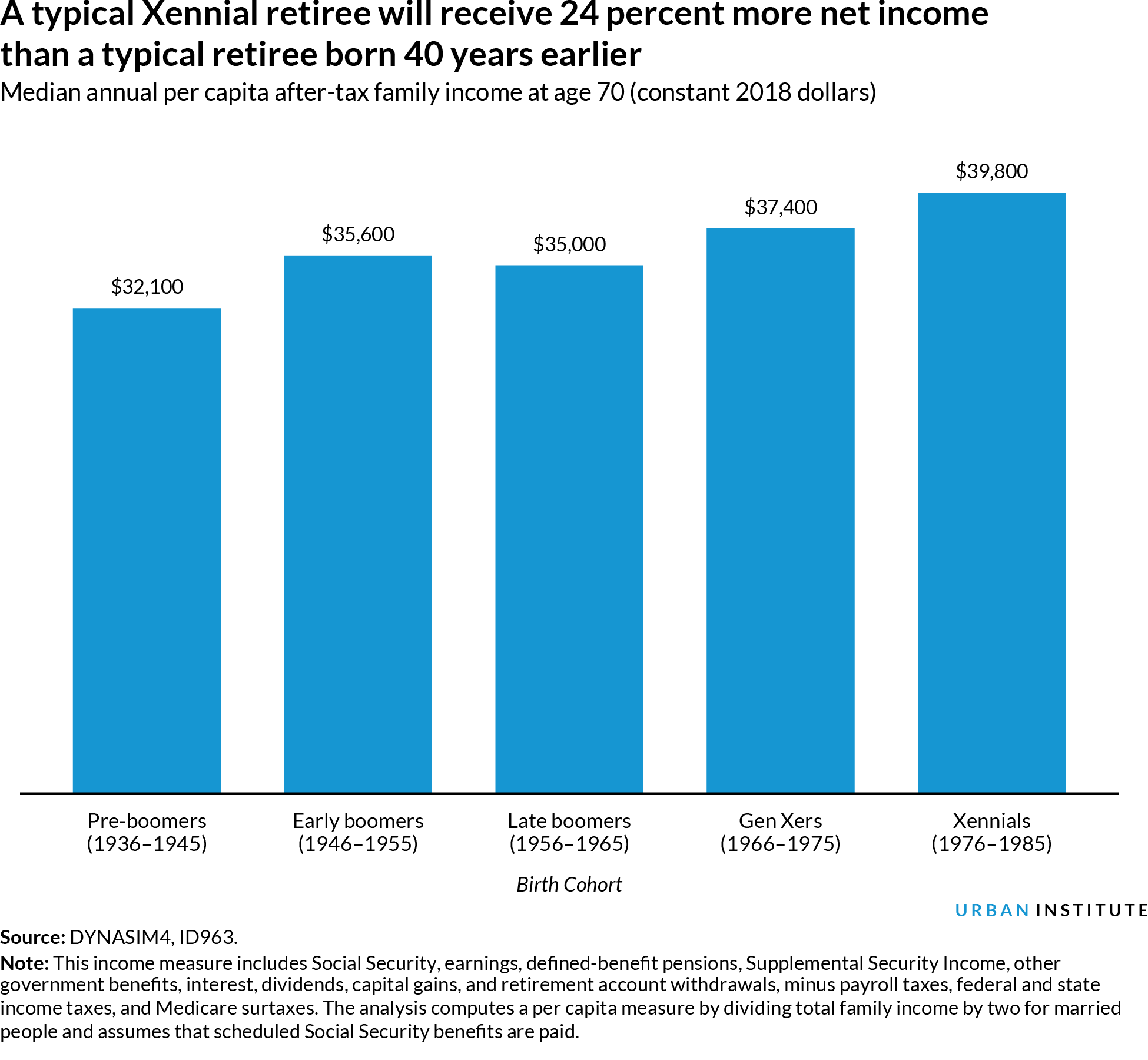

Early retirement among American seniors has been on the rise in recent years, and there are several reasons contributing to this trend. Firstly, many individuals are choosing to retire early because they have reached a point in their lives where they have achieved financial independence. With careful financial planning and saving, individuals are able to accumulate enough wealth to support themselves in retirement at an earlier age.

Additionally, the desire for a better work-life balance is another driving force behind the increase in early retirement. Many individuals prioritize their personal lives and leisure activities over their careers and choose to retire early to have more time for hobbies, travel, and spending quality time with their loved ones.

Financial Considerations in Early Retirement

Financial considerations play a crucial role in the decision to retire early. Saving enough money to sustain oneself for several decades is a significant challenge, and careful financial planning is necessary. Many individuals choose to work longer to increase their retirement savings and ensure a comfortable lifestyle throughout their retirement years.

Pensions, savings, investments, and Social Security benefits contribute to the financial foundation of early retirees. It is important to have a comprehensive understanding of these resources and how to maximize their benefits. Working with a financial advisor can help individuals navigate the complexities of early retirement planning and ensure a secure financial future.

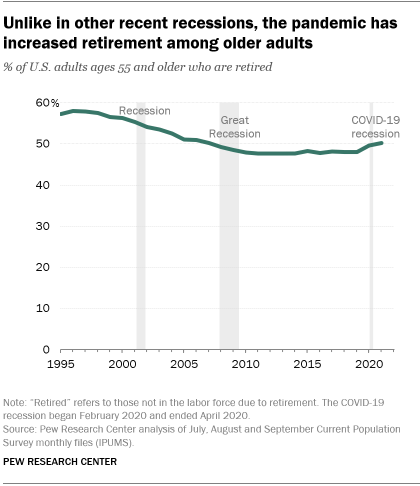

This image is property of www.pewresearch.org.

Health and Lifestyle Factors Influencing Early Retirement

Health and lifestyle factors also influence the decision to retire early among American seniors. As individuals age, health concerns may arise, making it difficult to continue working at the same pace or in physically demanding jobs. Retirement offers individuals the opportunity to focus on their health, prioritize self-care, and pursue a healthier lifestyle.

Moreover, individuals who have worked for several decades may experience burnout or feel the need to take a step back from their careers to focus on their personal well-being. Early retirement allows individuals to recharge, explore new interests, and enjoy a more relaxed lifestyle without the stress and demands of the workforce.

The Role of Social Security in Early Retirement

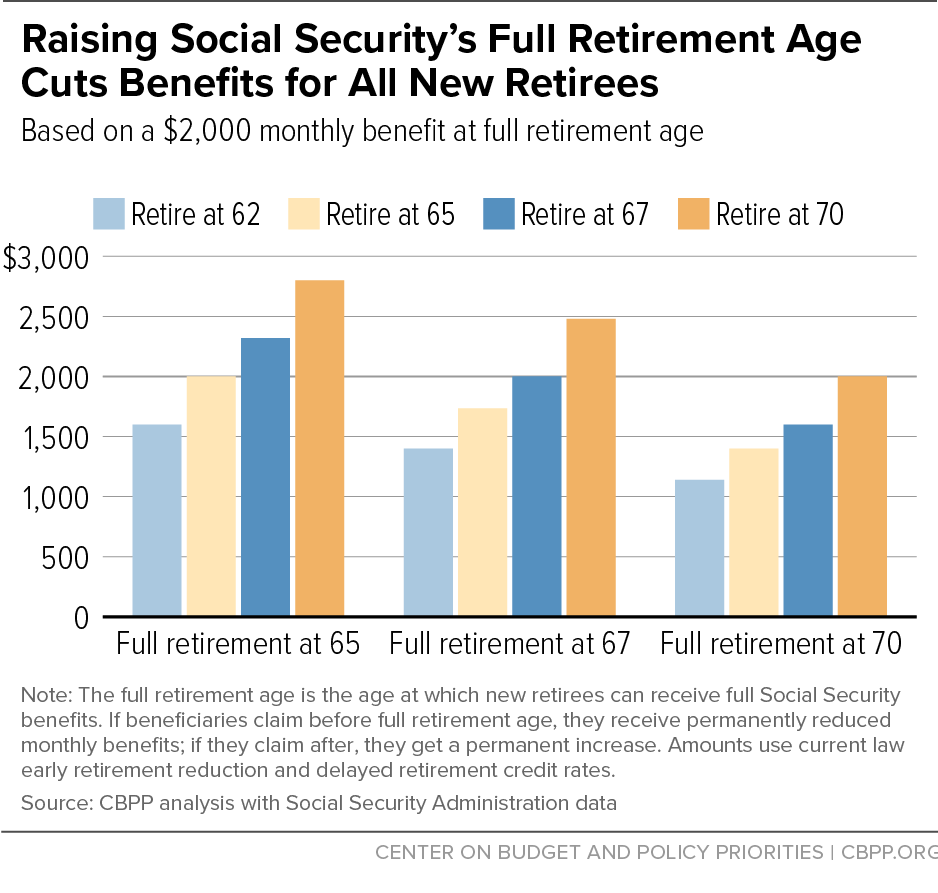

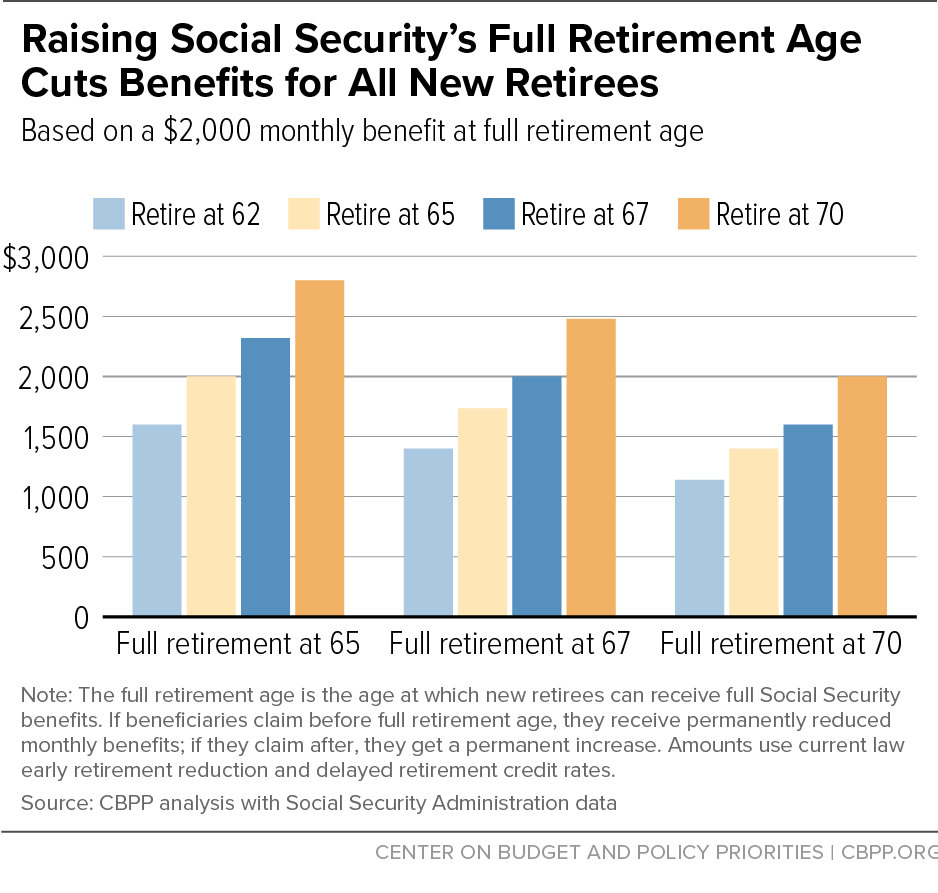

Social Security, a federal program designed to provide financial support to retired individuals, plays a crucial role in early retirement. Eligible individuals can start receiving Social Security benefits as early as age 62, providing a steady source of income during retirement years. However, it is important to note that taking Social Security benefits early can result in reduced monthly payments compared to waiting until full retirement age.

Many Americans rely on Social Security as a vital component of their retirement income. It is crucial for individuals considering early retirement to understand the implications and potential impact on their Social Security benefits. Consulting with a financial advisor or utilizing online resources can help individuals make informed decisions regarding the timing of their Social Security benefits.

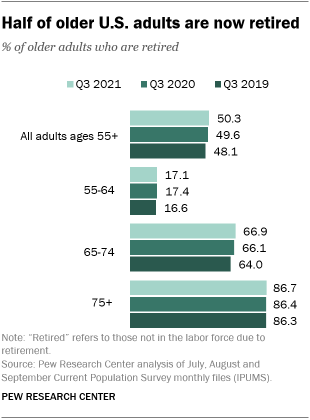

This image is property of www.pewresearch.org.

Implications of Early Retirement on Social Security

The growing trend of early retirement has implications for the Social Security system. With more individuals choosing to retire early, the strain on Social Security funds increases. This places a greater burden on the system, potentially leading to reduced benefits or changes in eligibility requirements in the future.

To maintain the longevity and sustainability of the Social Security system, policymakers may need to address the impact of early retirement. This could include implementing changes to the system, such as increasing the full retirement age or adjusting benefit calculations to ensure the program remains viable for future generations.

Effects of Early Retirement on the American Workforce

The increase in early retirement among American seniors has significant effects on the workforce. As more individuals choose to retire early, there is a loss of experienced and skilled workers in various industries. This can result in a shortage of talent and knowledge transfer gaps within organizations.

Furthermore, early retirement can create opportunities for younger generations to enter the workforce earlier and advance in their careers more rapidly. However, it is important to strike a balance to ensure a smooth transition that does not leave industries without the necessary expertise and experience.

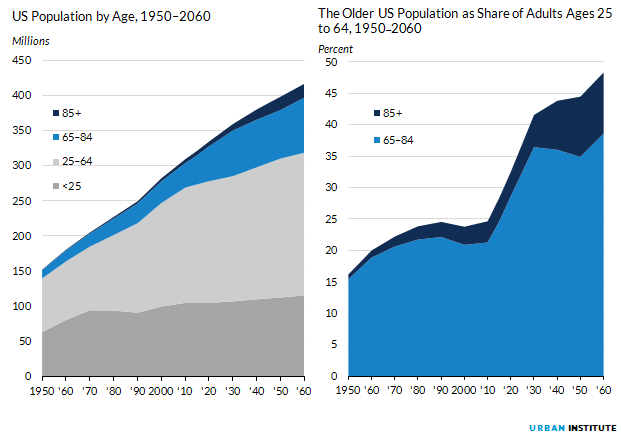

This image is property of www.urban.org.

Challenges Faced by Seniors in Early Retirement

While early retirement may seem like an enticing option, it is not without challenges. One of the main challenges faced by seniors in early retirement is healthcare costs. With rising medical expenses and the potential loss of employer-provided health insurance, retirees must navigate the complexities of Medicare and other healthcare options to ensure adequate coverage.

Another challenge is the potential for social isolation and loss of purpose. Retirement can be a major life transition, and individuals may find it difficult to adjust to a new routine and establish a sense of purpose in their daily lives. Maintaining social connections, pursuing hobbies, and engaging in meaningful activities can help alleviate these challenges.

Alternative Paths to Retirement for American Seniors

For American seniors considering early retirement, exploring alternative paths is essential. Some individuals may choose phased retirement, where they gradually reduce their working hours or transition into consulting or part-time work. This allows for a smoother transition into retirement while still maintaining income and the benefits of staying engaged in the workforce.

Others may consider entrepreneurship or starting a small business during retirement. This provides an opportunity for individuals to pursue their passions, generate income, and maintain a sense of purpose and fulfillment.

This image is property of www.urban.org.

The Impact of Early Retirement on the Economy

Early retirement has a significant impact on the economy. With more individuals leaving the workforce prematurely, there may be a potential labor shortage in certain industries. This can lead to increased competition for talent, higher wages, and potentially slower economic growth.

Furthermore, early retirees contribute to the economy through their spending habits. With more time for leisure activities, travel, and other consumer spending, early retirees can have a positive impact on various sectors of the economy, such as tourism, entertainment, and healthcare.

Policy Recommendations to Address the Early Retirement Trend

To address the growing trend of early retirement among American seniors, policymakers should consider implementing measures that encourage and support individuals in extending their working years. This could include providing incentives for employers to offer flexible work arrangements, creating training programs to enhance the skills of older workers, and promoting the benefits of phased retirement and continued engagement in the workforce.

Furthermore, policymakers should also focus on ensuring the sustainability of the Social Security system. This may involve making adjustments to the program, such as gradually increasing the full retirement age and implementing means-testing to target benefits to those who truly need them.

In conclusion, the growing trend of early retirement among American seniors is influenced by a variety of factors, including financial considerations, health and lifestyle factors, and the role of Social Security. While early retirement offers individuals the opportunity for personal fulfillment and a better work-life balance, it also presents challenges and has implications for the economy and the workforce. By understanding the reasons behind the trend and implementing appropriate policies, we can navigate the early retirement trend and ensure a sustainable future for both individuals and society as a whole.

This image is property of www.cbpp.org.